Overview: From Uniform Distribution to Targeted Liquidity

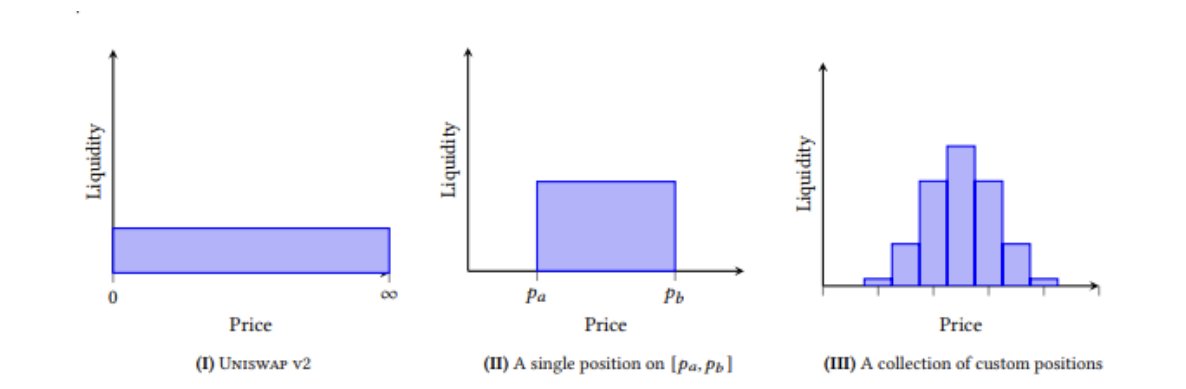

Automated Market Makers (AMMs) have revolutionized decentralized trading. While Uniswap V2 distributes liquidity uniformly across the entire price spectrum, Uniswap V3 introduces concentrated liquidity, allowing Liquidity Providers (LPs) to allocate funds within specific price ranges. This innovation significantly boosts capital efficiency and fee earnings.

In this article, we explain how concentrated liquidity works, its benefits, and its market impact. Additionally, you’ll find internal links to our Audits, Services, Workflow, and Reviews for further insights.

1. Background and Need

In Uniswap V2, liquidity was distributed evenly from zero to infinity, leaving much capital unused in many pools. Especially for stablecoin pairs like USDT/USDC—where most trades occur within a narrow price range—this leads to inefficient capital deployment.

Uniswap V3 addresses this inefficiency by enabling LPs to concentrate liquidity within a defined price range. For example, in an ETH/USDC pair, an LP might set their active range between $1,500 and $2,000, ensuring that funds are used exactly where needed.

2. How Concentrated Liquidity Works

Ticks and Price Increments

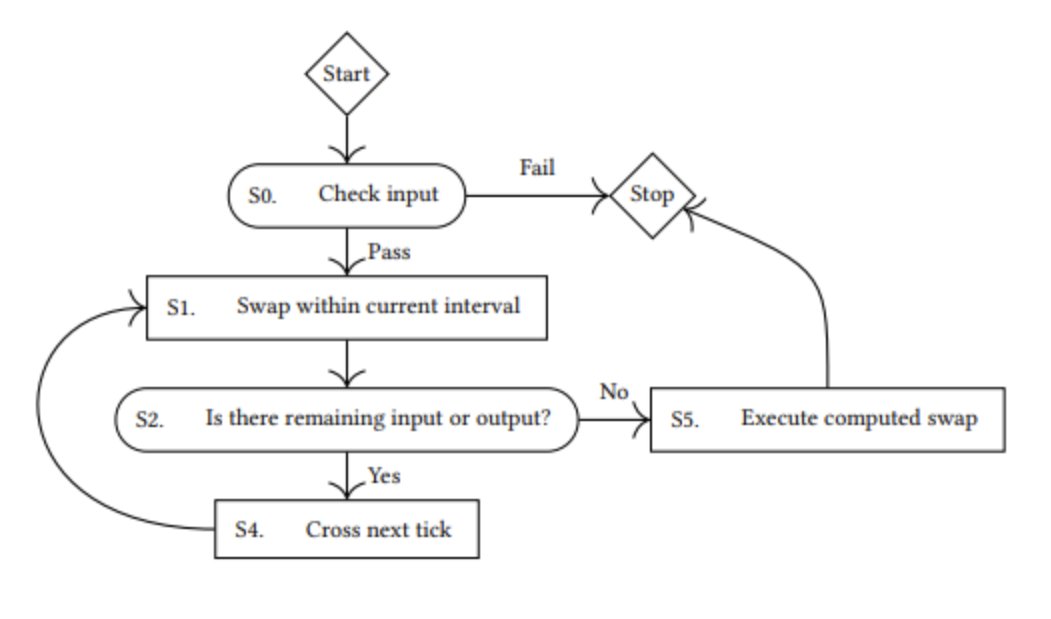

Uniswap V3 divides the price spectrum into discrete ticks—small intervals representing a 0.01% price change. LPs can specify exactly which tick range their liquidity should be active in.

Targeted Liquidity Provision

By concentrating liquidity within specific tick intervals, LPs maximize capital usage. When the market price falls within their designated range, the entire provided liquidity is deployed. If the price moves outside the range, the liquidity automatically becomes inactive until the price returns.

Example:

For an ETH/USDC pair, an LP may choose a range from $1,800 to $2,000. If the current price is $1,850, all liquidity is in play. Should a large order push the price beyond $2,000, only LPs positioned in the higher range will contribute liquidity.

3. Advantages of Concentrated Liquidity

- Enhanced Capital Efficiency:

- LPs earn higher fees because their capital is deployed precisely where trades occur.

- Reduced Price Impact:

- Concentrated liquidity leads to a flatter price curve for a given trade size, reducing slippage.

- Better Earnings Potential:

- Targeted liquidity enables LPs to achieve higher returns with the same capital compared to the uniformly distributed model of Uniswap V2.

4. Technical Details and Implementation

Mathematical Foundations

The price progression in Uniswap V3 follows the formula p(i) = 1.0001^i, allowing for minimal price changes per tick. Within a tick range, liquidity adheres to the constant product formula (x * y ≥ k).

Smart Contract Implementation

LPs specify their active tick boundaries directly in the smart contracts. Accurate implementation and regular audits—like those available via our Audits—are essential to safeguard the system.

[Image: Ideal placement here showing a code snippet that illustrates the implementation]

5. Outlook and Internal Linking

Concentrated liquidity represents a major advancement in decentralized exchange design. It not only improves efficiency but also offers LPs new avenues for higher returns.

For further insights and detailed analyses, please visit our sections on:

Conclusion

Uniswap V3’s concentrated liquidity model transforms liquidity deployment by optimizing capital utilization, reducing price impact, and enhancing earnings potential. Regular audits and robust technical measures ensure security, making this innovative model a key asset for LPs seeking to maximize returns.