Uniswap V2 and the “k Check”: Behind the Scenes of the Constant Product Formula

Overview

- Topic: The swap mechanism in Uniswap V2 and the core concept of x × y = k.

- Goal: Explain how the “k Check” enforces the constant product principle and why a transaction reverts if that principle is violated.

- Relevance: Essential for anyone working with DeFi and Automated Market Makers (AMMs).

1. The Core Principle: x×y=k

The foundation of Uniswap (and many other AMMs) is the constant product model. This model dictates that the product of the two token reserves in a pool—commonly labeled x for Token A and y for Token B—must remain at least a certain value k. As long as no liquidity is added or removed, this product is intended to stay effectively constant (minus fees). When a user swaps one token for another, the ratio between the two reserves changes, but the product x × y must not fall below the required threshold.

In practical terms:

- x = amount of Token A in the pool

- y = amount of Token B in the pool

- k = the constant product (approximately x × y)

During a swap, a trader adds some quantity of Token A and removes a certain quantity of Token B, or vice versa. The Uniswap protocol automatically adjusts prices so that x × y remains at or above the target value, accounting for fees. This is precisely where the “k Check” comes into play.

Note: If you want to verify whether your own smart contracts or DeFi projects correctly implement the constant product model, our team at BailSec offers comprehensive smart contract security audits and tailored solutions to ensure your code meets the highest standards.

2. The Critical Code: The “k Check” in the Swap Function

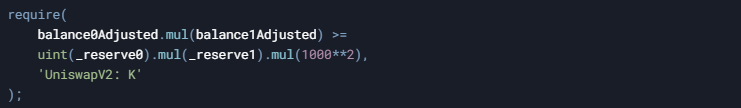

Inside the swap function of the UniswapV2Pair contract, there is often a line such as:

- Purpose: This ensures that the new product of the reserves (balance0Adjusted * balance1Adjusted) after a swap is not lower than the original product (including a factor for fees).

- Fee Factor (example): 1000**2 can suggest two steps of fee calculation (e.g., 0.3% each, depending on how the contract is structured). In many UniswapV2 implementations, you’ll see 997 instead of 1000, reflecting a 0.3% fee.

Why does this matter?

- Protection Against Manipulation: No one can withdraw more tokens from the pool than mathematically permissible.

- Safety for Liquidity Providers: Liquidity providers (LPs) are protected from unfair depletion of their pooled assets.

Tip: To learn more about our audit workflow, check out our process. At BailSec, we systematically examine such mechanisms to ensure they are robust against potential exploits.

3. UniswapV2 Does Not Automatically Calculate Your Output

A common misconception is:

“The contract calculates how many tokens I’ll receive.”

In fact, it works in reverse:

- You (or the frontend you use) specify how many output tokens you want.

- The smart contract checks whether your input amount satisfies the k Check.

- If yes, the swap proceeds; if not, the transaction reverts with the error UniswapV2: K.

This approach gives traders more control over slippage, allowing them to set the minimum amount of tokens they wish to receive before confirming the transaction.

4. Practical Example (Simplified, No Fees)

- Pool: 100 ETH (x) and 10,000 USDC (y)

- Product kkk: 100×10,000=1,000,000100 \times 10,000 = 1,000,000100×10,000=1,000,000

- Trader swaps 1 ETH: The ETH balance becomes 101 ETH

- New y: 1,000,000 / 101 ≈ 9,900.99 USDC

Hence, the trader can receive at most around 99.01 USDC (10,000 - 9,900.99) without violating the constant product. Asking for 100 USDC or more would make the protocol revert because it would push the product below 1,000,000.

Looking for more insights? Visit our blog for additional examples and in-depth technical analyses of DeFi protocols, smart contract development, and security considerations.

5. Significance for Liquidity Providers (LPs)

- Fairness: The k Check ensures that LPs do not give out more tokens than mathematically justified.

- Fees: LPs earn 0.3% (standard) from each trade, which the trader effectively pays. This fee is added to the pool, increasing its total value.

- Price Formation: The relative price of Token A to Token B (and vice versa) is automatically determined by the ratio of x to y. If someone attempts a large trade that drastically changes the ratio, they must deposit enough tokens to maintain x × y above the threshold.

6. The Role of Fees (1000**2 vs. 997)

In most implementations, you’ll see 997 instead of 1000, representing the 0.3% fee. That means:

- Out of 1,000 units of input tokens, 997 remain in the pool, and 3 are allocated to LPs.

- The product is adjusted accordingly so that the final check ensures no excessive extraction of tokens.

In your specific code snippet, 1000**2 might indicate two steps of 1,000 each (e.g., one for input and one for output calculations). The exact math can differ slightly between versions, but the overarching principle remains consistent.

7. Common Pitfalls and Best Practices

- Incorrect Output Calculation: If the trader sets the minimum output amount too high, the swap reverts.

- Misapplied Fees: A frequent mistake is miscalculating the 0.3% or 0.05% fee rate.

- Insufficient Code Review: Given the complexity of AMMs, a thorough audit is vital to detect hidden flaws. Check out our audit services for a detailed look at how we ensure your contract’s security.

Our Advice: Rigorously test your smart contracts and consider experienced auditors to identify any vulnerabilities before they become real-world issues.

8. Conclusion: The k Check as the Cornerstone of UniswapV2

The k Check in UniswapV2 is the cornerstone that enforces the constant product mechanism. It guarantees that the product x × y never drops below a certain threshold, thereby safeguarding both traders and liquidity providers. In practice:

- Traders specify the output token amount they desire, and the protocol verifies it against the constant product rule.

- Liquidity Providers benefit from stable pool reserves and fair fee distribution.

- Fees (e.g., 0.3%) are integrated directly into the math, adjusting the product accordingly.

Anyone delving deeper into AMM design and smart contract development should understand how x × y = k operates and how the k Check is implemented in code. This knowledge is critical to preventing manipulation and building stable, liquid markets over the long term.

Want to Learn More?

- Curious about how we at BailSec conduct thorough smart contract reviews?

- Interested in our audit workflow? Check out our workflow page for a closer look at our systematic approach.

- Visit our blog for more articles on DeFi, security, and blockchain development.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Final Assessment

- Logic and Code: The text accurately explains how UniswapV2Pair enforces the k Check.

- Fee Calculation: The reference to 1000**2 is plausible, while many standard versions use 997 to reflect a 0.3% fee.

- Structure: A blend of continuous text and subheadings to facilitate readability and emphasize key points.