Avoiding Staking Errors with Transfer-Tax Tokens: The Before-After Pattern

Smart contract development requires a deep understanding of the peculiarities of various token standards and implementations. Transfer-tax tokens present a particular challenge, especially when combined with staking mechanisms, as they can lead to serious accounting errors. This article explains how the "Before-After Pattern" elegantly solves this problem.

What Are Transfer-Tax Tokens?

Transfer-tax tokens are ERC20 tokens with a special feature: every transfer automatically incurs a fee or "tax". This implementation is particularly popular in DeFi projects that aim to:

- Incentivize long-term holding

- Automatically fill liquidity pools

- Burn tokens to create deflation

- Fund development treasuries

Example: With a token that has a 5% transfer tax, when transferring 100 tokens, the recipient only receives 95 tokens. The remaining 5 tokens are redistributed, burned, or otherwise utilized according to the tokenomics.

The Problem: Staking Mechanisms and Transfer Tax

Staking contracts typically follow a simple pattern:

- The user transfers tokens to the staking contract

- The contract updates the user's staking balance based on the transferred amount

- During withdrawal, tokens are returned according to the recorded balance

This is where the problem with transfer-tax tokens arises: the staking contract records the full amount that the user intended to transfer but receives fewer tokens due to the transfer tax.

This discrepancy leads to overbooking in the contract. Over time, a growing deficit develops, which can lead to the following problems:

- Users cannot withdraw all their stakes

- "First come, first served" situations where early withdrawers are favored

- Faulty reward calculations

- In the worst case: Complete blocking of the withdrawal mechanism

The Solution: The Before-After Pattern

The most elegant solution to this problem is the "Before-After Pattern", which accurately measures the tokens actually received:

This approach has several advantages:

- Precise accounting: The contract only records tokens that were actually transferred

- Transparency: The user can track the actually staked amount via events

- Robustness: The mechanism works regardless of the amount of transfer tax

- Future-proofing: Even if the transfer tax is dynamic or changes, the solution remains functional

Important: Add Reentrancy Protection

Since the Before-After Pattern breaks the Check-Effects-Interaction (CEI) principle, reentrancy protection is essential:

The nonReentrant modifier prevents a function from being called recursively before the first execution is completed. This is crucial as a malicious token could intervene between the balance check and the balance update.

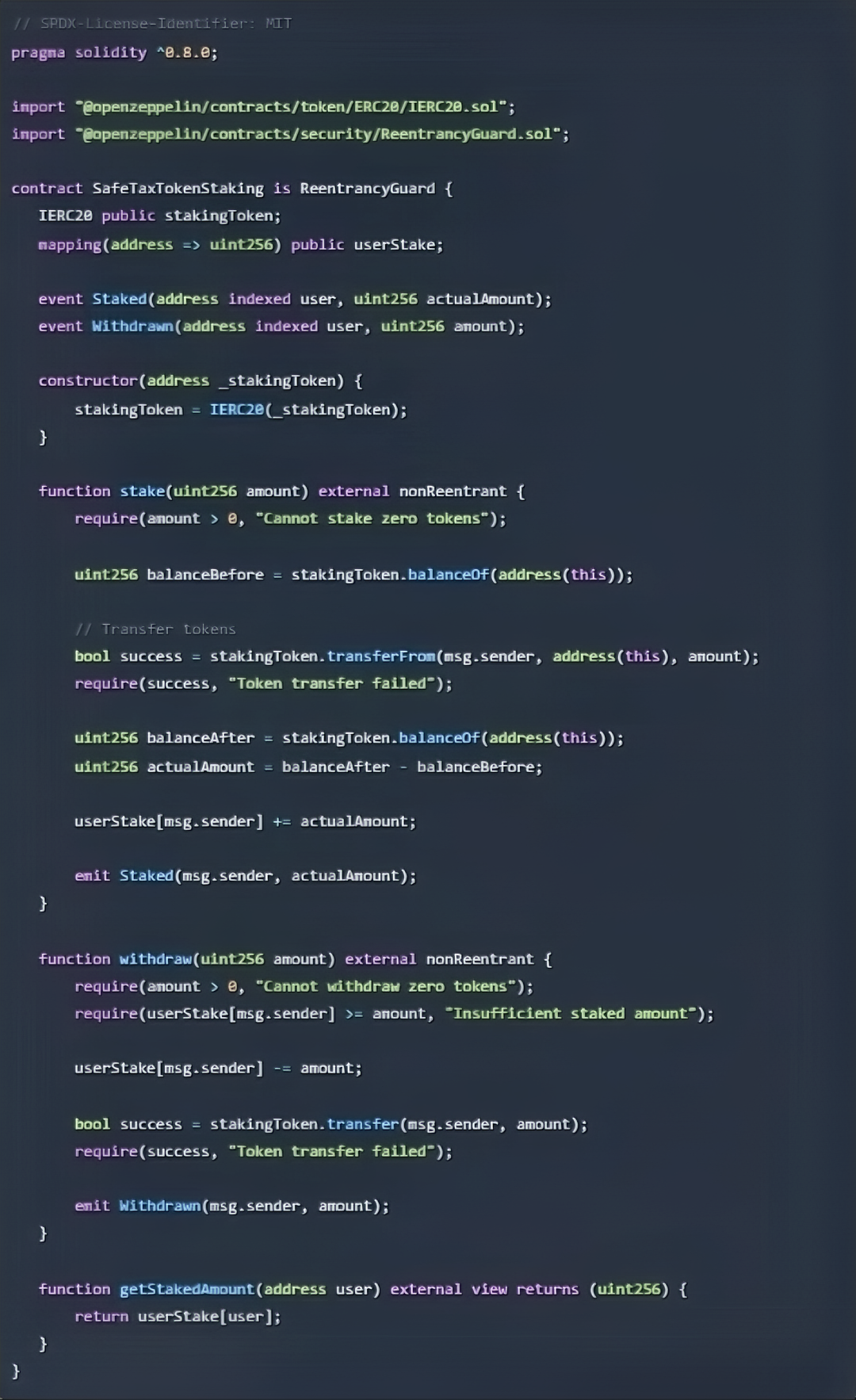

Complete Example of a Secure Staking Contract

Here is a complete, secure staking contract that is compatible with transfer-tax tokens:

solidity

Recommendations for Smart Contract Audits

At BailSec, we have analyzed numerous staking implementations and found that the correct handling of transfer-tax tokens is often overlooked. As part of our comprehensive audit process, we specifically check for:

- Correct implementation of the Before-After Pattern

- Appropriate reentrancy protection measures

- Precise event emissions for transparency

- Edge cases, such as changes to the transfer tax rate

Our proven workflow ensures that these and other potential vulnerabilities are systematically identified before they lead to problems in production.

Conclusion: Robust Smart Contracts Through Thoughtful Implementation

Transfer-tax tokens require special attention when integrated into staking mechanisms. The Before-After Pattern offers an elegant and robust solution for the precise accounting of tokens actually transferred. Combined with reentrancy protection, this approach can effectively prevent potential accounting problems.

For more information on smart contract security and best practices, regularly visit our blog or contact our team of experts for individual consultation