Introduction

Implementing deadline checks in smart contracts is a critical security measure in the decentralized world. An improper or missing deadline check can result in transactions being executed outside the intended timeframe, leading to significant financial losses and security risks. In this blog post, we delve deep into the risks associated with faulty deadline validations and outline the benefits of proper implementation – supported by detailed examples, technical analysis, and audits conducted by Bailsec.

Background: The Importance of Deadline Checks in Smart Contracts

Smart contracts are frequently used for time-sensitive operations such as token swaps, liquidity provisioning, and flash loans. A deadline parameter is typically used to ensure that a transaction is executed within a specified window. If this check is missing or implemented incorrectly, several issues may arise:

- Delayed Execution: Transactions may remain pending for hours or even days in the mempool.

- Market Fluctuations: Significant price changes can occur between transaction submission and execution.

- Transaction Ordering Manipulation: Attackers can exploit the situation by performing sandwich attacks, thereby profiting at the expense of the user.

Technical Analysis and Detailed Case Study: Bob’s Scenario

1. Delayed Execution and Market Changes

Consider the following scenario:

Initial Situation:

Bob intends to swap 500 XYZ for 5 ETH and subsequently sell 5 ETH for 10,000 USDC. This is a common operation where quick and accurate execution is essential.

Transaction Gets Stuck:

To reduce costs, Bob sets a low gas fee. Miners then prioritize other, more profitable transactions, causing his swap to remain stuck in the mempool for hours or even days.

Bob intends to swap 500 XYZ for 5 ETH and subsequently sell 5 ETH for 10,000 USDC. This is a common operation where quick and accurate execution is essential.

Transaction Gets Stuck:

To reduce costs, Bob sets a low gas fee. Miners then prioritize other, more profitable transactions, causing his swap to remain stuck in the mempool for hours or even days.

- Concrete Figures: After several hours of waiting, the transaction is finally executed, but market conditions have significantly deteriorated.

Market Conditions Change:

During the delay, the price of ETH drops considerably. Instead of receiving the expected 10,000 USDC, Bob ends up receiving only 6,500 USDC for his 5 ETH.

During the delay, the price of ETH drops considerably. Instead of receiving the expected 10,000 USDC, Bob ends up receiving only 6,500 USDC for his 5 ETH.

- Technical Insight: Bob’s minimum output parameter (minOut) of 5 ETH should normally yield a higher amount if executed immediately. However, the delay causes the parameter to become misaligned with current market conditions.

Sandwich Attack:

Additionally, an MEV bot executes a sandwich attack by placing transactions immediately before and after Bob’s swap, further manipulating the price.

Additionally, an MEV bot executes a sandwich attack by placing transactions immediately before and after Bob’s swap, further manipulating the price.

- Outcome: Bob ultimately receives only 5 ETH, even though a fair execution would have resulted in 8 ETH or an equivalent fair value.

2. Transaction Ordering Manipulation

Without a defined deadline, attackers can monitor the mempool and strategically insert transactions:

- Sandwich Attacks:

- Impact:

3. Additional Technical Considerations

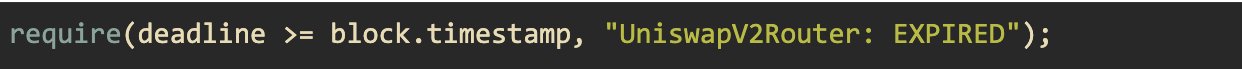

- Use of block.timestamp:

- Potential Pitfalls:

- Incorrect Implementation:

In-Depth Risk Analysis and the Benefits of Proper Implementation

Risks of Improper Deadline Checks

Financial Losses:

As demonstrated in Bob’s example, delayed transactions can lead to substantial financial losses – losing 3,500 USDC in a single transaction can quickly add up if many users are affected.

Increased Vulnerability to MEV:

Missing deadlines allow MEV bots to manipulate transaction order and profit from the delay at the expense of users.

Loss of User Trust:

Repeated security flaws and unpredictable transaction execution can erode user trust in the decentralized platform over time.

As demonstrated in Bob’s example, delayed transactions can lead to substantial financial losses – losing 3,500 USDC in a single transaction can quickly add up if many users are affected.

Increased Vulnerability to MEV:

Missing deadlines allow MEV bots to manipulate transaction order and profit from the delay at the expense of users.

Loss of User Trust:

Repeated security flaws and unpredictable transaction execution can erode user trust in the decentralized platform over time.

Benefits of a Correct Deadline Implementation

Minimized Losses:

Enforcing a proper deadline check ensures transactions are executed within the desired timeframe, thereby reducing the risk of financial losses due to market fluctuations.

Enhanced Security:

A correctly implemented deadline ensures transactions occur within a controlled window, making it significantly harder for attackers to perform sandwich attacks or other manipulative tactics.

Strengthened User Confidence:

Transparent and secure transaction processes build user trust – especially when audits, such as those conducted by Bailsec, are in place.

Learn more about our audit findings on our Audits page

Competitive Advantage:

Projects that rigorously secure their smart contracts and conduct regular audits stand out from competitors, attracting more investors and users.

Enforcing a proper deadline check ensures transactions are executed within the desired timeframe, thereby reducing the risk of financial losses due to market fluctuations.

Enhanced Security:

A correctly implemented deadline ensures transactions occur within a controlled window, making it significantly harder for attackers to perform sandwich attacks or other manipulative tactics.

Strengthened User Confidence:

Transparent and secure transaction processes build user trust – especially when audits, such as those conducted by Bailsec, are in place.

Learn more about our audit findings on our Audits page

Competitive Advantage:

Projects that rigorously secure their smart contracts and conduct regular audits stand out from competitors, attracting more investors and users.

Recommended Security Measures and Best Practices

Technical Measures

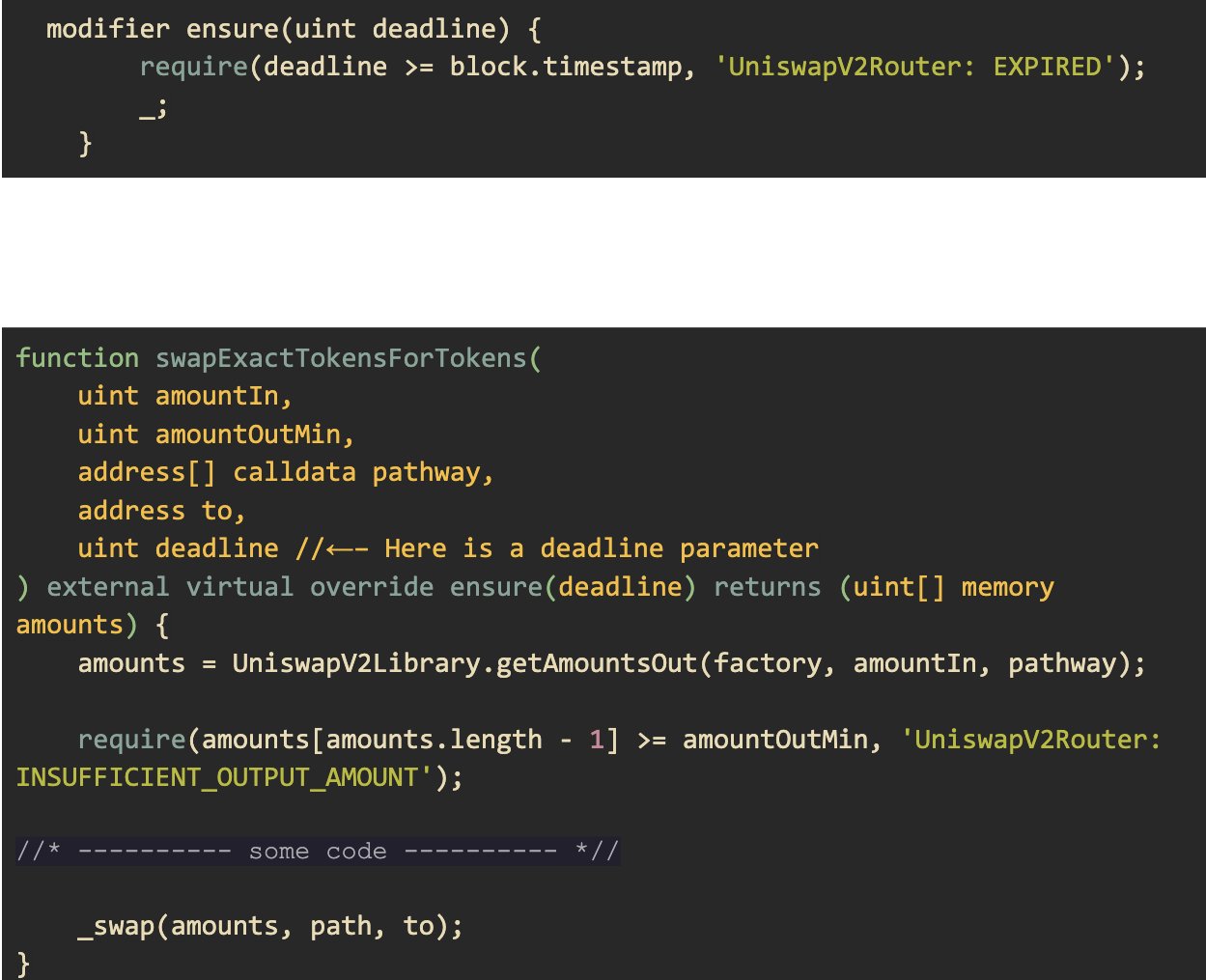

- Strict Deadline Validation:

- Accurate Parameter Settings:

Organizational Measures

- Regular Audits by Bailsec:

- Monitoring and Alert Systems:

Strategic Recommendations

- Fostering a Security Culture:

- Feedback Integration:

Future Outlook: The Evolution of Smart Contract Security

As decentralized applications grow in complexity, the importance of robust security measures increases. While attackers continuously evolve their tactics, developers must remain proactive and innovative in implementing protective mechanisms. Proper deadline checks are a key component of a comprehensive security strategy – complemented by measures such as multisig authentication, time-based transaction limits, and sophisticated monitoring systems.

Conclusion

The correct implementation of deadline checks in smart contracts is crucial for avoiding financial losses and protecting against MEV-based attacks. Bob’s case study and the detailed risk analysis clearly demonstrate that even minor oversights in deadline validation can lead to significant disadvantages. By adopting strict technical measures, conducting regular audits – as performed by Bailsec – and fostering a strong security culture, these risks can be substantially reduced. Ultimately, such measures not only enhance overall security but also build stronger trust among users and investors.