Liquid Staking Unveiled: The Technology Powering Stader Labs BNBx

The Technical Architecture of Liquid Staking

Liquid Staking is more than an investment concept – it's a complex technological solution redefining the boundaries of traditional blockchain investments. Using Stader Labs as an example, the technical mechanisms become particularly clear.

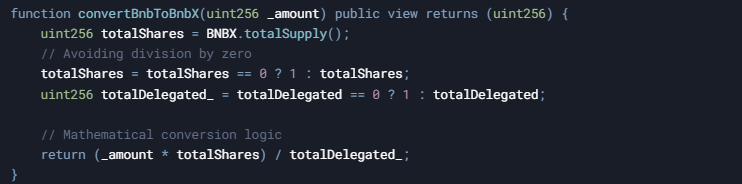

The Conversion Process: From BNB to BNBx

Imagine you want to make your BNB tokens more productive. The process begins with a precise mathematical calculation. The convertBnbToBnbX function is the key to token conversion:

Practical Example: Let's say you invest 100 BNB. The smart contract precisely calculates how many BNBx tokens you'll receive. If 10,000 BNBx are already in circulation and 5,000 BNB are delegated, the algorithm will convert your tokens accordingly.

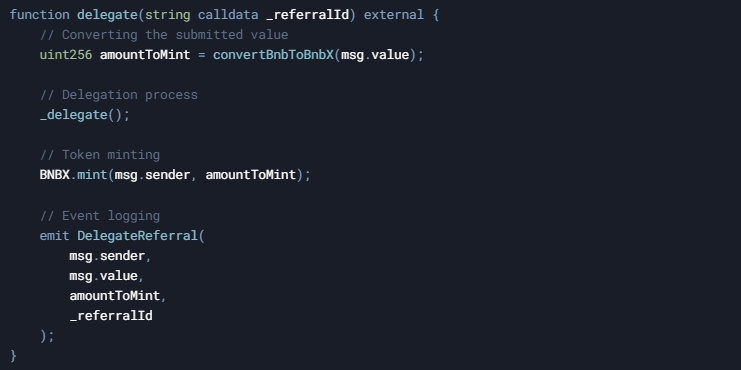

The Delegation Mechanism: Security and Efficiency

The delegate() mechanism demonstrates the process's complexity:

Security Features:

- Precise value calculation

- Automatic token generation

- Comprehensive event documentation

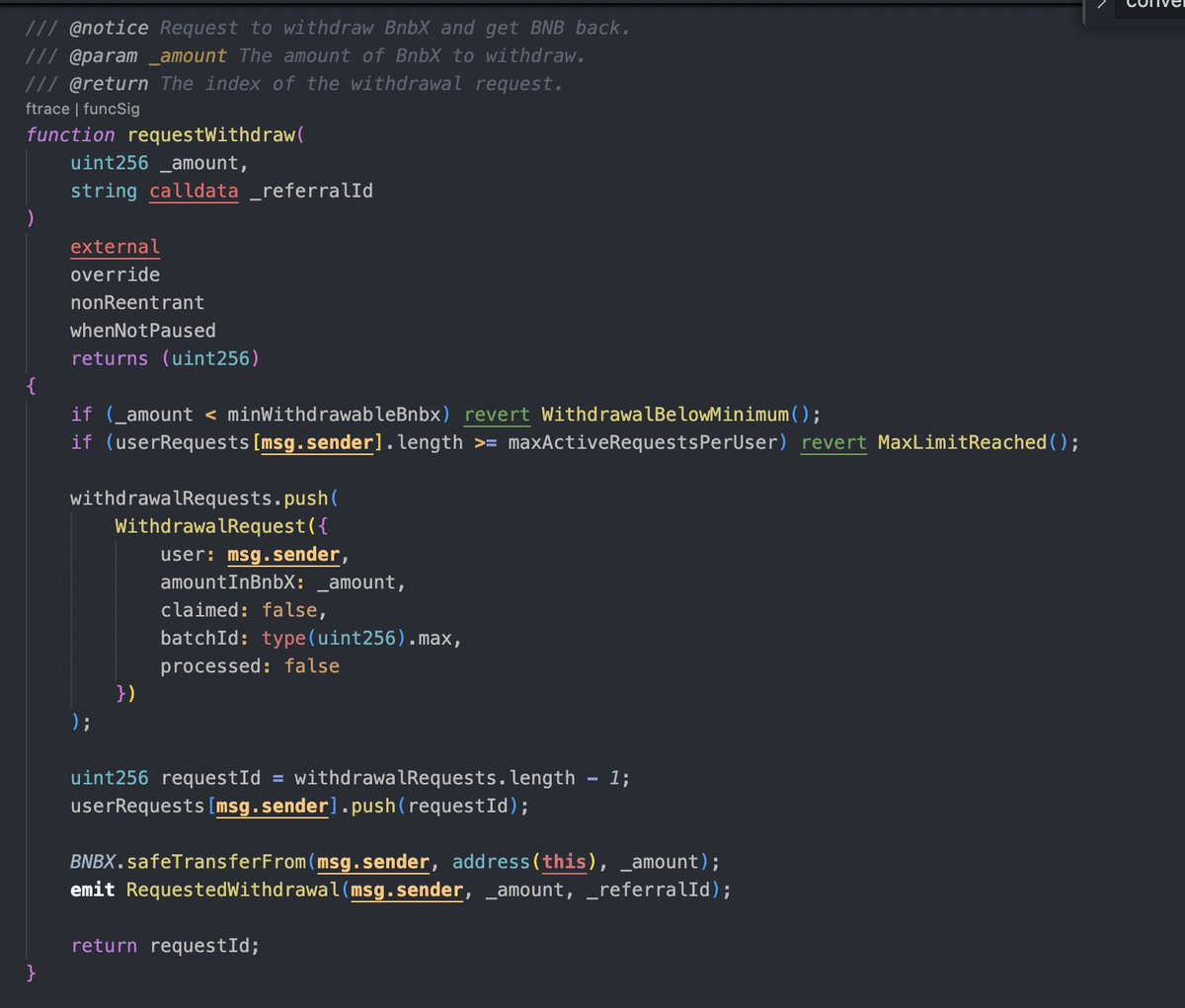

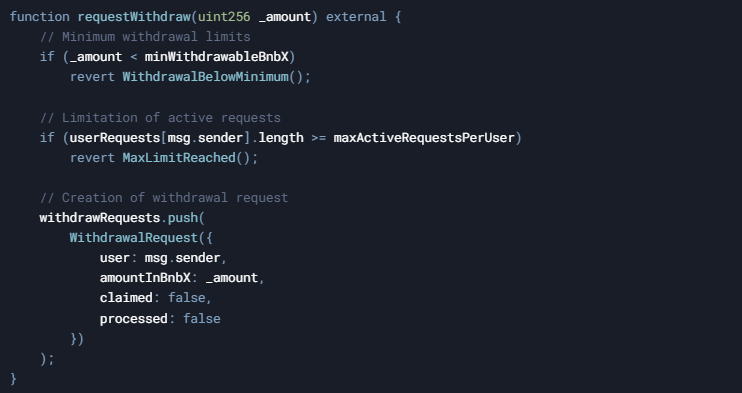

Withdrawal Process: Complex Security Mechanisms

The requestWithdraw() function implements multi-layered security checks:

Real-World Technology Impact

A concrete scenario: An investor with 50 BNB could:

- Immediately receive BNBx tokens

- Generate staking rewards

- Simultaneously use tokens in other DeFi protocols

Technical Challenges and Solutions

Implementing Liquid Staking requires:

- Mathematically precise calculation algorithms

- Highly secure smart contracts

- Dynamic adaptability

Risk Minimization

Stader Labs minimizes risks through:

- Multiple security verifications

- Mathematical protection algorithms

- Transparent tokenization mechanisms

Future Outlook

Liquid Staking represents more than an investment strategy – it's a technology platform that:

- Increases blockchain liquidity

- Expands investor opportunities

- Promotes decentralization

Disclaimer: Technical analysis. Not investment advice.